New Era Of Collaborating Fin-Tech Industry With Entrepreneurship

NexWallet collaborates closely with several banks to offer customers digital banking alternatives. NexWallet will increase consumer adoption while banks will still be the custodian of the customer and the numerous banking products and services.

We are delighted to announce the launch of NexWallet Payments, a Fintech company specializing in Neo Banking Solutions and providing a Unified Open API Platform. NexWallet collaborates closely with several banks to offer customers digital banking alternatives. NexWallet will increase consumer adoption while banks will still be the custodian of the customer and the numerous banking products and services. By providing its customers with a single, unified platform with a wide range of products for total financial support, it challenges traditional transaction experiences. It seeks to offer MSMEs a range of goods and services, such as:

- AEPS

- BBPS

- Multi-Recharge

- Verification

- KYC and Insurance

- DMT

- Micro ATM

- Account Openings

- Loans

- Hotels & Flight Bookings

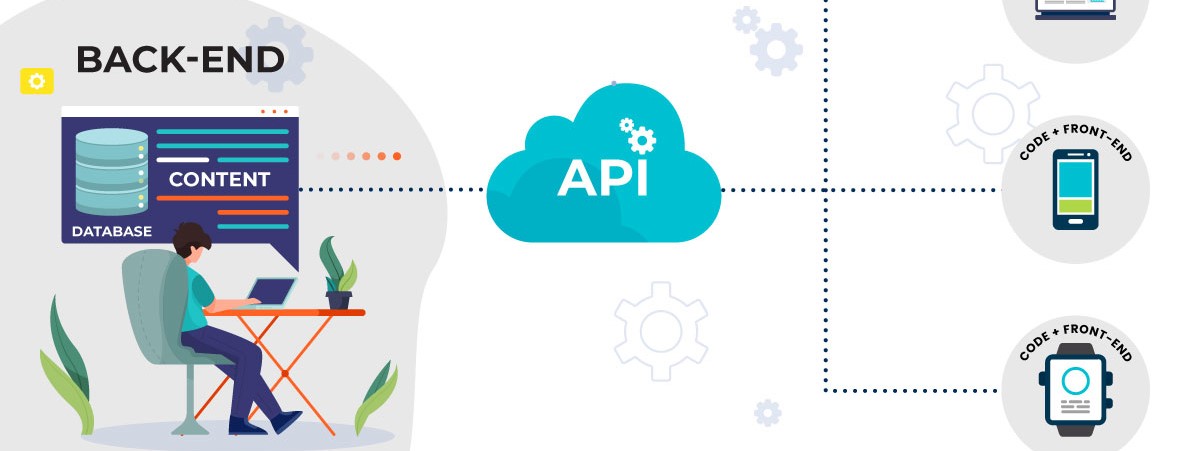

What Is An API?

A set of established guidelines known as an API, or application programming interface, allows various apps to communicate with one another. The company can open its application data and functionality to external third-party developers, business partners, and internal departments within their companies thanks to this intermediary layer, which handles data transfers across systems. An API's definitions and standards enable businesses to link their numerous applications daily, saving staff time and eradicating the silos that impede innovation and cooperation. The interface for communication between apps is provided through the API documentation for developers, simplifying applications' integration. The interfaces known as "fintech APIs" allow apps to communicate with the corresponding financial data and services that are stored on the servers of a company, organization, or bank.

How Does An API Work?

An easy approach to comprehending how APIs function is to consider a prevalent example, such as third-party payment processing. An eCommerce website may ask users to "Pay with Paypal" or another third-party system when purchasing. The connection is made by this function using APIs. An API request to get information when a customer clicks the payment button is called a call. The Uniform Resource Identifier (URI) of the API is used to handle this request, which comes with a request verb, headers, and occasionally a request body from an application to the web server.

What Are The Differences Between Online & Offline Transactions?

A direct bank-to-bank transfer known as an offline transfer enables you to transfer money between accounts. Wire networks like the Federal Reserve Wire Network (FEDWIRE) and the Society for Worldwide Interbank Financial Telecommunication (SWIFT) are used to send money electronically. Your transfer may be routed through a number of correspondent banks along the way to the target bank account throughout this process. Every transaction is subject to payment gateway fees.

Online transfers are where the antiquated idea of wiring money and cutting-edge electronic funds transfer technologies meet (EFT). People can transmit money (or the data that represents that money) to another person using online transfers. It is also known as Internet Money Transfer because it can be carried out using any computer with an internet connection. To send online transfers, you need a reputable and trusted money transfer company. Up to 2,000 merchant UPI transactions are exempt from payment gateway fees.

Which One Is Better And Safer?

- Both of the transactions are secure.

- Each has a check and balance system.

- Both concern the corresponding bank accounts.

- DMT does not gratify the customer and still involves some friction in completing transactions.

- Overall With a UPI, the procedure can be finished in a short amount of time. Fewer steps and time are required to complete a transaction, which reduces friction.

- Additionally, it seems easier and more straightforward to do a UPI transaction as long as there is no additional fee.

Conclusion

A Fintech startup called NexWallet Payments specialises in Neo Banking Solutions and offers a Unified Open API Platform. It challenges conventional transaction experiences by offering consumers a single, unified platform with a wide selection of solutions for overall financial support. An API, or application programming interface, is a collection of pre-established rules that enables communication between different apps. Businesses may link the various programmes they use on a daily basis, saving workers time and removing the silos that prevent collaboration and creativity. APIs are used to communicate with financial data and services, such third-party payment processing, that are kept on a company, organisation, or bank's servers.

Our latest Blog

What is Travel API? 7 Steps to Integrate in Your Portal

Looking to integrate travel services into your business software? Check out best travel API service provider with 7 easy steps to integrate.

How Banking UPI Services Impacting Various Business Industries?

The adoption of digital payments and all other FinTech services will depend on how well the sector can reassure clients and earn their trust so that they feel safe and secure while using the service.

How do Payment APIs help in providing Payment Solutions

In many ways, the usage of APIs is driving the development of India's financial services sector. It has increased teamwork with partners.....