How Banking UPI Services Impacting Various Business Industries?

The adoption of digital payments and all other FinTech services will depend on how well the sector can reassure clients and earn their trust so that they feel safe and secure while using the service.

How Banking UPI Services Impacting Various Business Industries?

- The supply of innovative financial solutions by IT venture businesses is referred to as "FinTech," which is the combination of the terms "finance" and "technology." New business models are being developed, particularly in the domain of B to C services using the Internet. These new enterprises' attitude toward IT investment differs fundamentally from traditional finance organizations.

- Financial services are undergoing significant changes due to information technology, making them more usable and accessible. Before, banks and credit card firms were among the players in the payment services industry. Nonetheless, several new players have entered the market, making things simpler and more advantageous for the nation's populace. UPI payments consequently affected the fintech industry.

Why Is UPI Expanding So Quickly?

1. UPI services have gained widespread acceptance and confidence. As the card information is not shared with the merchants when you use UPI to make purchases, you are protected from data leaks even if the retailers are compromised.

2. The ease with which UPI payments can be used to pay and register is another factor altering the Fintech sector. All that is necessary to verify your UPI is the authentication of your Aadhar card, scanning of your fingerprints, and confirming your mobile phone number.

How Has UPI Affected India's Fintech Sector?

The adoption of UPI payments is primarily to blame for the Indian fintech market's projected $31 billion growth in 2020. This is mainly due to the fact that India is the only nation in the world with more than a billion mobile connections and biometrics, which offers sufficient room and opportunity for the penetration of fintech technology.

Reasons Why UPI Is So Much Hyped In The Market?

UPI has made e-commerce purchasing and selling simpler: UPI has simplified buying and selling for e-commerce businesses using fintech app solutions. The Internet of Things (IoT) allows various devices to connect, making it feasible to collect historical data on people's daily routines. These life records enable e-commerce platforms to examine legal and criminal activity trends, enhancing their ability to identify illegal conduct.

Increasing customer and business trust: UPI payments have fostered trust between buyers and sellers. This is a result of the system's continued maintenance of privacy. All UPI transactions must be initiated by the payer and approved by an OTP. The person-to-person (P2P) transfer is the main emphasis of this.

No need for virtual wallets: Whereas many virtual wallet providers, such as Paypal, Paytm, Mobikwik, etc., need you to deposit money into the wallet, UPI payment allows you to spend funds directly from your savings account.

Keep a record of your bank transactions with UPI: This saves time for people who would otherwise have to visit the bank to update their passbooks by allowing them to keep track of their withdrawals and deposits. The elderly, who do not need to go to banks and may transfer any amount they wish using an application, gain significantly from this.

Conclusion

Another breakthrough made by UPI in the past two years is the ability to seek credit using your overdraft (OD) account. This most recent value addition eliminates the risk of fraudulent credit card calls and the risk assessment associated with conventional bank credit facilities. As a result, UPI has helped the Fintech Industry develop a culture of innovation and entrepreneurship, and we couldn't be happier about it. It improved transfer security and revolutionized the concept of daily payments.

Our latest Blog

What is Travel API? 7 Steps to Integrate in Your Portal

Looking to integrate travel services into your business software? Check out best travel API service provider with 7 easy steps to integrate.

New Era of Collaborating Fin-Tech Industry with Entrepreneurship

We are delighted to announce the launch of NexWallet Payments, a Fintech company specializing in Neo Banking Solutions and providing a Unified......

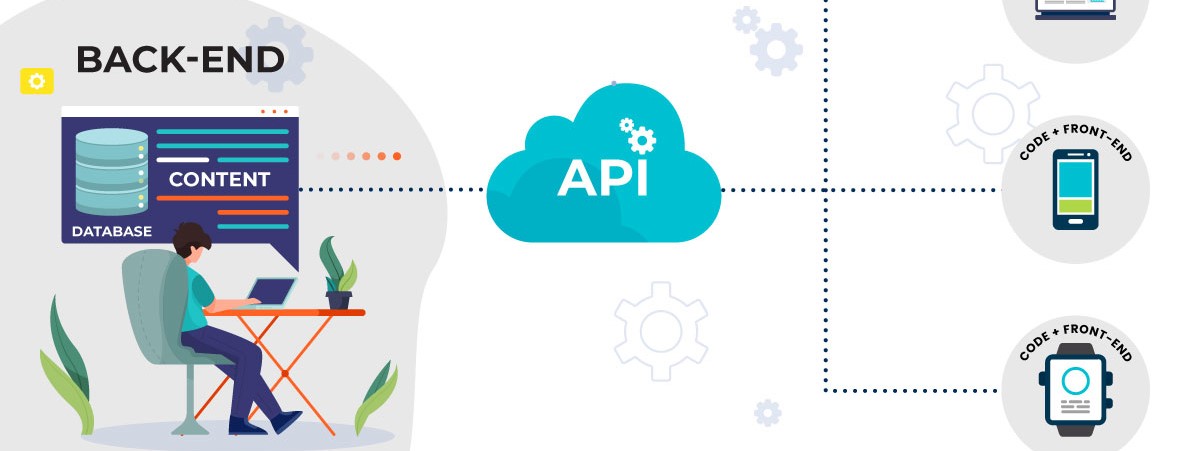

How do Payment APIs help in providing Payment Solutions

In many ways, the usage of APIs is driving the development of India's financial services sector. It has increased teamwork with partners.....